by Shoreline Financial | Dec 29, 2020 | 2020, Accountants, Blog, Business Owners, tax

For the 2020 tax year, the Government of Canada introduced a temporary flat rate method to allow Canadians working from home this year due to Covid-19 to claim expenses of up to $400. Taxpayers will still be able to claim under the existing rules if they choose using...

by Shoreline Financial | Oct 13, 2020 | 2020, Blog, Coronavirus, Coronavirus - Associates, Coronavirus - Practice Owners

The Canada Recovery Benefit (CRB) is now open for applications.As described on the Canada.ca website, the CRB gives income support to employed and self-employed individuals who are directly affected by COVID-19 and are not entitled to Employment Insurance...

by Shoreline Financial | Oct 9, 2020 | 2020, Blog, Coronavirus, Coronavirus - Practice Owners

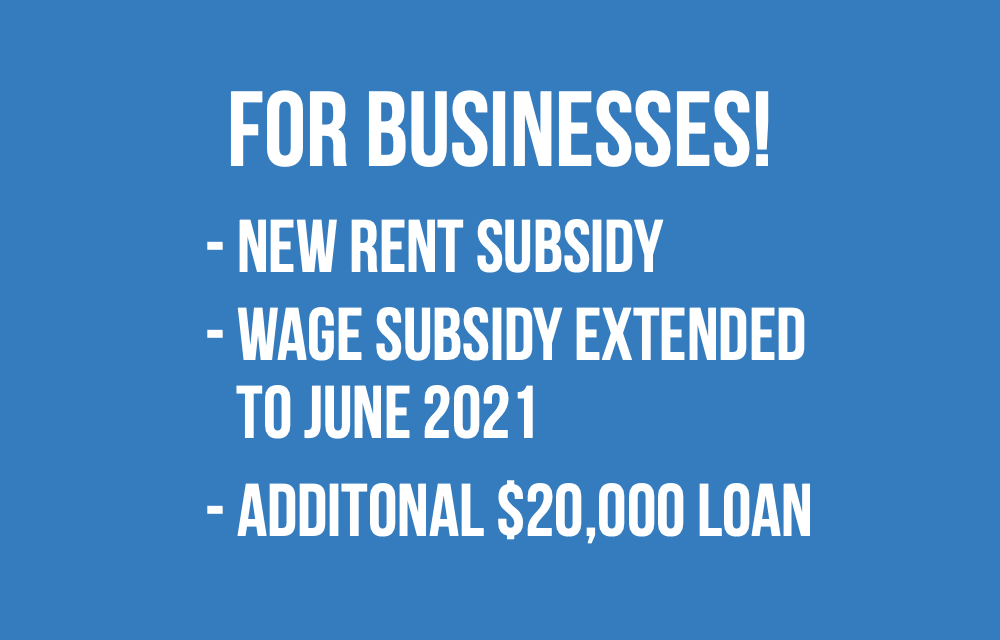

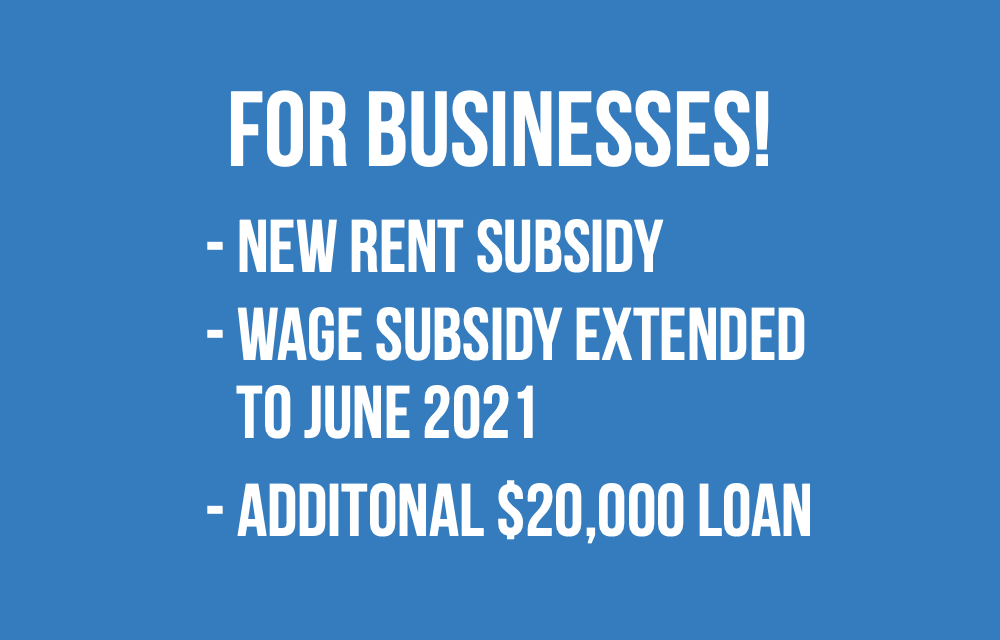

On October 9th, the Federal Government announced the new Canada Emergency Rent Subsidy (CERS), the extension of the Canada Emergency Wage Subsidy (CEWS) and additional loans through the Canada Emergency Business Account (CEBA).New Canada Emergency Rent Subsidy for...

by Shoreline Financial | Aug 21, 2020 | 2020, Blog, Coronavirus, Coronavirus - Associates, Coronavirus - Practice Owners, Coronavirus - Retired, Coronavirus - Retiring, Coronavirus - Students

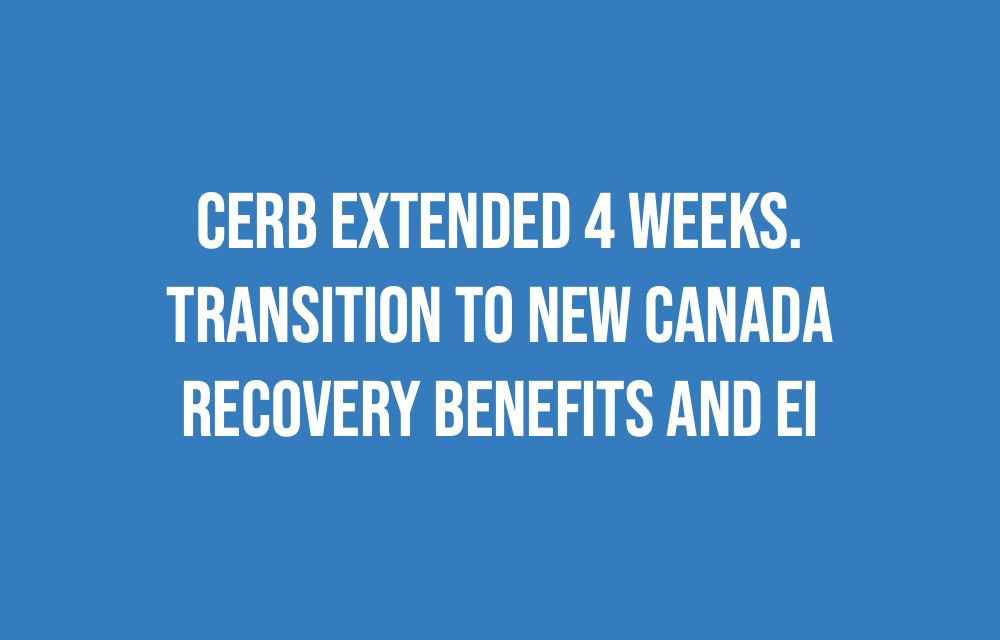

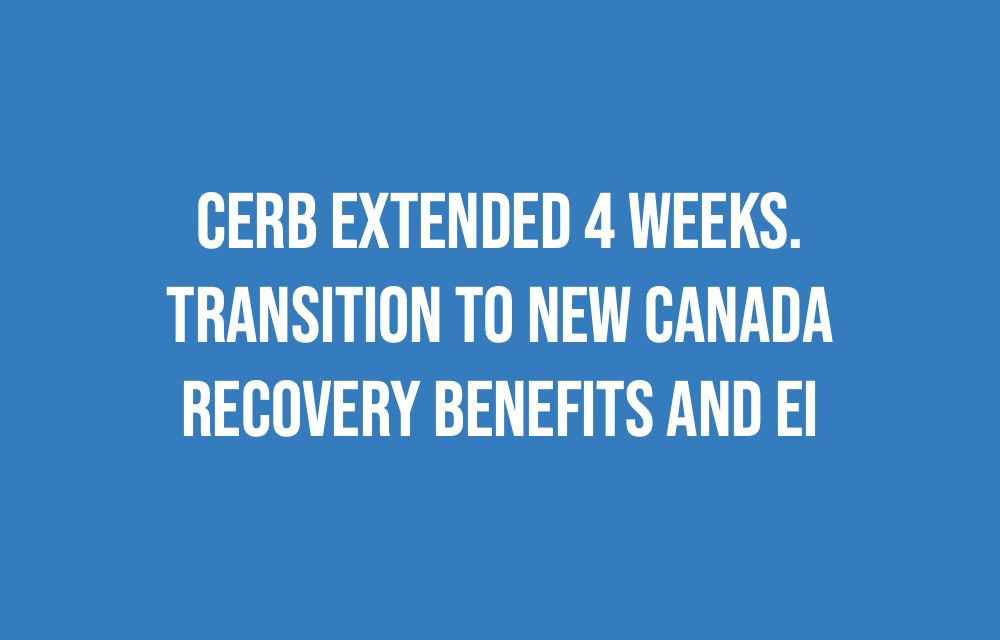

CERB extended by 4 weeks On August 20th, the Federal Government announced the extension of the Canada Emergency Response Benefit (CERB) by one month and the subsequent transition, on September 27th, to a simplified Employment Insurance (EI) Program for those who...